Pago

Empowering Unbanked Individuals and SMEs

Doga Dogan

Starring as UX Designer

Context

X Bank, one of Turkey's prominent financial institutions, ventured into the fintech space with Pago, targeting unbanked individuals and a broad customer base. Our mission was to develop the MVP for Pago from scratch, introducing two primary products: a Virtual POS system tailored for SMEs and a Prepaid Card for a wider user group. I was part of the project's initial phase, focusing on crafting the Virtual POS system and setting the foundation for the introduction of the Prepaid Card.

My role

UX Designer

Platform

Web App

Timeline

2021- Ongoing

NDA

Due to the confidential nature of the project, I’m unable to share specific details and changed the name of our client.

Problems

As we started the project, our client presented a broad concept: a fintech platform aimed at bypassing banking regulations to reach unbanked individuals. The brief lacked specificity, mentioning only two desired products, and their goal was to create a platform mirroring that of a direct competitor, which left us navigating a vague direction. To understand potential users, we relied on the client's market research and conducted our own secondary research, leading to these findings:

Complexity in Finance

The financial sector's complex jargon and the vast array of products often make it daunting and difficult to comprehend. This complexity poses a major obstacle to financial inclusion, hindering the empowerment of many individuals who struggle to navigate the financial landscape.

Desire for Financial Control

A recurring theme was the desire for control over financial decisions. Stemming from negative past experiences and a deep mistrust of banks, there's a clear demand for platforms that offer full transparency and control, enabling users to manage their finances independently.

Technological Pace and Understanding

We also found that the rapid evolution of technology, combined with a general lack of understanding and limited attention spans, makes it difficult for many to keep up with new financial tools. This disconnect calls for fintech solutions that are not only innovative but also accessible and easy to comprehend for the average user.

According to a January 2022 report, more than 30% of Turkey's population remains unbanked. (Credolab 2022)

Goal & Design Principles

After our research and reviewing the documents shared with us, our primary goal for Pago was to create a website and system that effectively showcases the experiences of unbanked young individuals and SME owners. Since there was no clear brand vision, to achieve this goal, we established five key design principles, serving as our guiding disciplines throughout the project. These principles were designed to ensure consistency in our approach and keep us aligned with our overarching goal:

Inclusivity

Focus on creating a platform where everyone, especially the unbanked and SME owners, feels represented and valued.

Ease of Use

Design a user-friendly interface that simplifies the financial journey for all type of users.

Control

Empower users with tools and features that offer them full control over their financial decisions.

Communicative

Develop an engaging and communicative interface that effectively conveys Pago's values and product benefits.

Concept to MVP

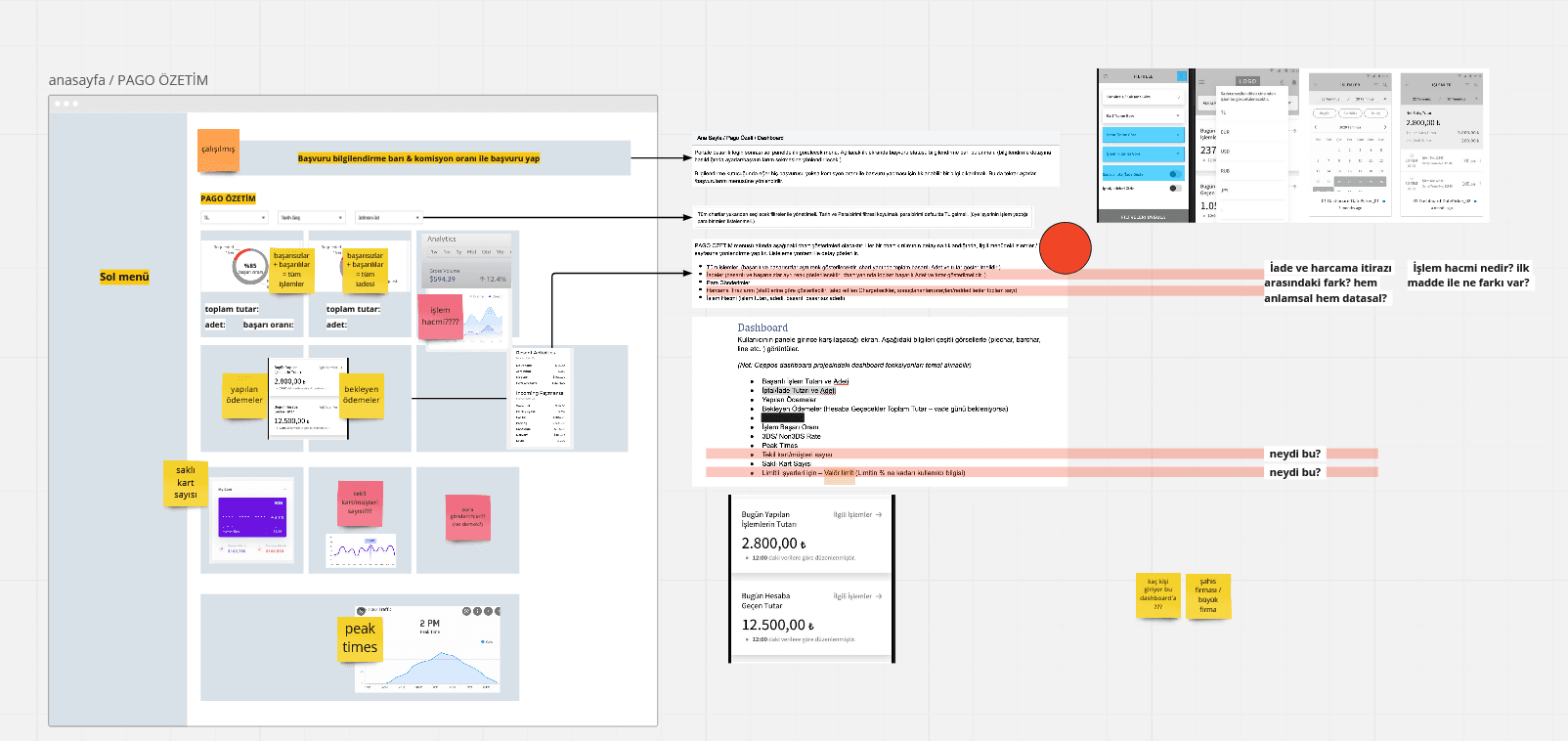

After research and defining the main principles for design, we began working on Pago's MVP, organized into three key stages. Our first task involved creating landing pages for both the prepaid and POS card products, with a design focused on inclusivity and universal appeal. This approach effectively showcased Pago as a welcoming brand for a diverse audience, and it was well-received by executives, ensuring consistency with their overall branding strategy.

Next, we moved on to establish the information architecture for the Virtual POS product. After laying this groundwork, each team member started working individually on the primary features and user flows.

My main responsibilities

Transactions

PagoLink

Payments

Subscriptions

Before wireframing, our team did daily meeting sessions to discuss client documents and exchange feedback on our approaches.

Final Designs: Website

After completing the initial wireframes for the landing page, we maintained a strong focus on the human aspect of the design, especially since we didn't have a clear brand guideline. Our goal was to demonstrate that Pago is a platform for everyone, where users can find representation of themselves, fostering a sense of connection and trust.

Final Designs: Transactions

The Transactions section serves as a central hub for users to view and manage their financial activities in detail. It's designed for clarity and ease, showcasing payment histories, returns, and other key transactions. The layout is optimized to prevent information overload, ensuring users can effortlessly navigate through crucial sections like cancellations, suspicious activities, and dispute filings.

Final Designs: PagoLink

PagoLink supports anyone venturing into selling products online, from students to side hustlers. It enables easy creation and management of product links, with a layout that allows users to conveniently track sales directly from each link, simplifying online business operations.

Testing Core Features

After finishing dashboard and transaction related screens for the first phase of the project, we wrote our hypotheses and planned 3 different scenario for 2 different group: people who would use POS and people who will use link payment system. After testings, we added our notes, group them in Airtable to analyse and presented the findings to the POs to confirm the prioritization of the changes.

Scenarios

3

User Tested

12

Task Completion Rate

90%

Frames Prototyped

85

“It is very simple, clean and usable panel for POS system.”

User 4 - SME, long time user of virtual POS system

That’s all?

After implementing changes from the testing results, we wrapped up the main work on the Virtual POS section and transitioned to focusing on the Prepaid segment. In this phase, my contributions included competitor analysis and shaping the information architecture. As new projects arrived at the agency, my direct role in Pago reduced, though I continued to provide occasional support in design decisions and feedback for the evolving Prepaid Card product. The current plan, to my knowledge, is to launch Pago in Q2 2024.

My Ending + Challenges Faced

Pago, still in active development, presented a unique set of challenges during my involvement. From grappling with unclear briefs to deciphering complex technical jargon, each obstacle posed a distinct challenge. These were some of the most significant issues I had to overcome during my time:

Unclear Product Vision

The project kicked off with a brief from the client that was rather vague, especially in terms of the fintech platform's specific features and functionalities. Adding to the challenge, the brand identity had not been established at the outset and only began to form during our web app design process, making it a bit like piecing together a puzzle without a clear picture to guide us.

Limited Technical Resources

Finding relevant Virtual POS examples was challenging, as they were mostly hidden behind login screens and tailored for specific user groups. Additionally, the finance sector's technical jargon complicated our understanding. We often had to rely on discussions with product owners to clarify and guide our design of flows.

Navigating overlapping phases

One of the biggest challenges I faced occurred when some deadlines were unexpectedly pushed forward, and there was an urgent need to design some of the features that we discussed as phase 2 for phase 1. During this period, we had to work intensively with multiple stakeholders, including product owners for both the prepaid card and virtual POS systems, as well as the bank's backend and frontend developers. This situation demanded an exceptionally high level of coordination and constant communication to ensure that we stayed aligned and made progress, despite the overlapping and rapidly evolving phases of the project.